Minsk T20 - Banana 1H

- Minsk

- AIMSter

- Posts: 498

- Joined: 11 Nov 2021, 16:11

- 4

23-6-2022 Updated Trading plan

Updated Trading plan.

Less pairs, and some changes in risk and trade management.

Pips, I need to learn to use these as they are in the Trading Plan now. Im used to just eyeballing if a SL is big or small.

Less pairs, and some changes in risk and trade management.

Pips, I need to learn to use these as they are in the Trading Plan now. Im used to just eyeballing if a SL is big or small.

You do not have the required permissions to view the files attached to this post.

Last edited by Minsk on 24 Jun 2022, 07:56, edited 1 time in total.

- Minsk

- AIMSter

- Posts: 498

- Joined: 11 Nov 2021, 16:11

- 4

23-6-2022 no trades today

Another day without trades. Charts on my list didn't come up with anything useful today.

Let's say this is good for my patience.

And not being in a trade is also a positon.

Let's say this is good for my patience.

And not being in a trade is also a positon.

- immy

- Founder

- Posts: 9654

- Joined: 22 Nov 2010, 16:46

- 15

Re: 23-6-2022 no trades today

No Valid Signals, No Trades. Best OutcomeMinsk wrote: 23 Jun 2022, 15:36 Another day without trades. Charts on my list didn't come up with anything useful today.

Let's say this is good for my patience.

And not being in a trade is also a positon.

What is the Secret of Successful Trading?

The Consistent Pursuit of DS1

The thing that makes me money in trading is when I "Objectively Follow my Trading Plan".

I understand that I can't catch all the moves or all the signals but my objective is to catch THE VALID SIGNALS & ONLY the Valid Signals.

My Deathbed Advice "5:1 Reward to Risk Ratio".

Yo, banana boy!

The Consistent Pursuit of DS1

The thing that makes me money in trading is when I "Objectively Follow my Trading Plan".

I understand that I can't catch all the moves or all the signals but my objective is to catch THE VALID SIGNALS & ONLY the Valid Signals.

My Deathbed Advice "5:1 Reward to Risk Ratio".

Yo, banana boy!

- tombacon89

- AIMSter

- Posts: 384

- Joined: 05 Feb 2012, 18:26

- 14

Re: 23-6-2022 Updated Trading plan

Please if I may, and also tell me to do one I will not be offended.Minsk wrote: 23 Jun 2022, 15:00 Updated Trading plan.

Less pairs, and some changes in risk and trade management.

Pips, I need to learn to use these as they are in the Trading Plan now. Im used to just eyeballing if a SL is big or small.

rather than stating…

• Is there an Impulse Wave? I know I am eager to take a trade so this is a very vital & crucial question.

have you considered simply asking ….. is there an impulse wave?

The only reason I say this, is if you read this every day before you trade. Which one page is very very simple and easy to do… and probably a quick win habit to do, you will remind yourself every day, that you are ‘eager and keen to take a trade’ you are simply,.. more likely subconsciously to take a trade because, like me, you feel the need to make best use of your time and take a trade to justify your time.

you don’t need to remind yourself that you feel the need to trade. Don’t reinforce a negative. The need to trade, in my opinion l, and I feel it too, is a negative….

but do, maybe somewhere state your awesome thought of ‘not taking a trade is still taking a position’

‘if the market does not present my setup, I will take a capital preservation decision’

#thelittlethingsarethebigthings

I hope this make sense. It is subtle, but hopefully very meaningful

'Do Not let yourself get in the way of your profit producing tools'

"If it’s meant to be, the universe is gonna throw it back to me, to get it back all we need is to let it go, put your faith put your trust in the chemicals" - Various Cruelties - Chemicals

"If it’s meant to be, the universe is gonna throw it back to me, to get it back all we need is to let it go, put your faith put your trust in the chemicals" - Various Cruelties - Chemicals

- Minsk

- AIMSter

- Posts: 498

- Joined: 11 Nov 2021, 16:11

- 4

Re: 23-6-2022 Updated Trading plan

That defo makes sense.tombacon89 wrote: 24 Jun 2022, 00:15Please if I may, and also tell me to do one I will not be offended.Minsk wrote: 23 Jun 2022, 15:00 Updated Trading plan.

Less pairs, and some changes in risk and trade management.

Pips, I need to learn to use these as they are in the Trading Plan now. Im used to just eyeballing if a SL is big or small.

rather than stating…

• Is there an Impulse Wave? I know I am eager to take a trade so this is a very vital & crucial question.

have you considered simply asking ….. is there an impulse wave?

The only reason I say this, is if you read this every day before you trade. Which one page is very very simple and easy to do… and probably a quick win habit to do, you will remind yourself every day, that you are ‘eager and keen to take a trade’ you are simply,.. more likely subconsciously to take a trade because, like me, you feel the need to make best use of your time and take a trade to justify your time.

you don’t need to remind yourself that you feel the need to trade. Don’t reinforce a negative. The need to trade, in my opinion l, and I feel it too, is a negative….

but do, maybe somewhere state your awesome thought of ‘not taking a trade is still taking a position’

‘if the market does not present my setup, I will take a capital preservation decision’

#thelittlethingsarethebigthings

I hope this make sense. It is subtle, but hopefully very meaningful

The way I wrote was to clarify the reason this Q is so important, and it's even better to leave it out, so not imprinting "aeger to take a trade" in my brain.

I am going to change that in the trading plan.

Thank you!

- Minsk

- AIMSter

- Posts: 498

- Joined: 11 Nov 2021, 16:11

- 4

Pips, how many are there

Working with a number of pips is new for me.

So googled this picture.

Reminder for assessing if SL and pullback candles aren't too big.

It would be nice if it was possible in MT4 to hover over a candle and it would display it number of pips from low to high.

So googled this picture.

Reminder for assessing if SL and pullback candles aren't too big.

It would be nice if it was possible in MT4 to hover over a candle and it would display it number of pips from low to high.

You do not have the required permissions to view the files attached to this post.

- immy

- Founder

- Posts: 9654

- Joined: 22 Nov 2010, 16:46

- 15

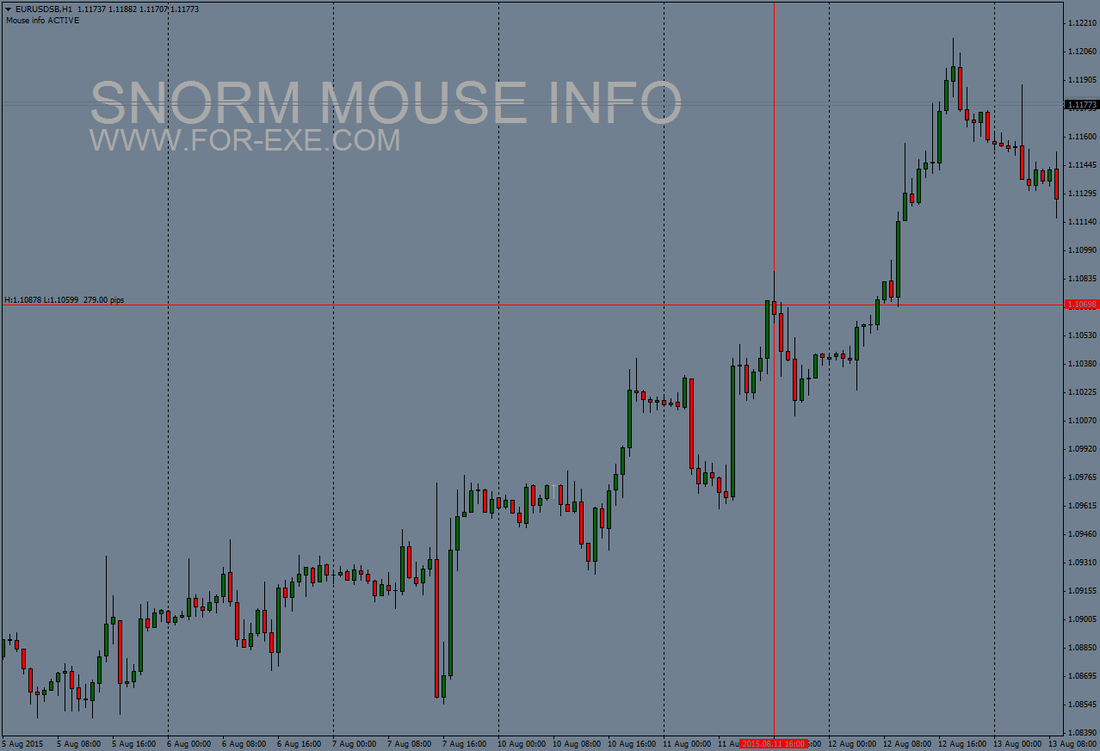

Re: Pips, how many are there

something like this ?Minsk wrote: 24 Jun 2022, 08:49 Working with a number of pips is new for me.

So googled this picture.

Reminder for assessing if SL and pullback candles aren't too big.

It would be nice if it was possible in MT4pips.PNG

to hover over a candle and it would display it number of pips from low to high.

Get the Mouse Info Indicator

Get the Mouse Info Indicator Shows information, on the chart, about a bar

https://www.for-exe.com/uploads/1/1/3/9 ... e_info.ex4

What is the Secret of Successful Trading?

The Consistent Pursuit of DS1

The thing that makes me money in trading is when I "Objectively Follow my Trading Plan".

I understand that I can't catch all the moves or all the signals but my objective is to catch THE VALID SIGNALS & ONLY the Valid Signals.

My Deathbed Advice "5:1 Reward to Risk Ratio".

Yo, banana boy!

The Consistent Pursuit of DS1

The thing that makes me money in trading is when I "Objectively Follow my Trading Plan".

I understand that I can't catch all the moves or all the signals but my objective is to catch THE VALID SIGNALS & ONLY the Valid Signals.

My Deathbed Advice "5:1 Reward to Risk Ratio".

Yo, banana boy!

- immy

- Founder

- Posts: 9654

- Joined: 22 Nov 2010, 16:46

- 15

Re: Pips, how many are there

Handle And Dealing PricePrice quotes on most currency trading platforms are composed of what is known as the "big figure," or "handle," and the "dealing price," which is understood to move in pips. For example: in quote 1.0485, the first portion of the quote, 1.04, is understood to be the "handle," and the last two digits of the quote, 85, are the dealing price in pips.Minsk wrote: 24 Jun 2022, 08:49 Working with a number of pips is new for me.

So googled this picture.

Reminder for assessing if SL and pullback candles aren't too big.

It would be nice if it was possible in MT4pips.PNG

to hover over a candle and it would display it number of pips from low to high.

Just like a cent or a penny is a 100th of a dollar or pound or euro, a pip is a 100th of a cent and later they changed it from 4 digits on the right of the decimal point (comma for Europeans, weird) to 5 digits and hence a tenth of a pip was born called pippett.

The handle, or big figure, changes only when there is greater movement in currency prices, while the dealing price in pips customarily changes frequently in intraday trade.

What is the Secret of Successful Trading?

The Consistent Pursuit of DS1

The thing that makes me money in trading is when I "Objectively Follow my Trading Plan".

I understand that I can't catch all the moves or all the signals but my objective is to catch THE VALID SIGNALS & ONLY the Valid Signals.

My Deathbed Advice "5:1 Reward to Risk Ratio".

Yo, banana boy!

The Consistent Pursuit of DS1

The thing that makes me money in trading is when I "Objectively Follow my Trading Plan".

I understand that I can't catch all the moves or all the signals but my objective is to catch THE VALID SIGNALS & ONLY the Valid Signals.

My Deathbed Advice "5:1 Reward to Risk Ratio".

Yo, banana boy!

- Minsk

- AIMSter

- Posts: 498

- Joined: 11 Nov 2021, 16:11

- 4

Re: Pips, how many are there

Thank you so much, that makes life easier!immy wrote: 24 Jun 2022, 09:07something like this ?Minsk wrote: 24 Jun 2022, 08:49 Working with a number of pips is new for me.

So googled this picture.

Reminder for assessing if SL and pullback candles aren't too big.

It would be nice if it was possible in MT4pips.PNG

to hover over a candle and it would display it number of pips from low to high.

Get the Mouse Info Indicator

Shows information, on the chart, about a bar

https://www.for-exe.com/uploads/1/1/3/9 ... e_info.ex4

- Minsk

- AIMSter

- Posts: 498

- Joined: 11 Nov 2021, 16:11

- 4

Copied from Cafe - Understanding Price, move and trend - D1 and H1

Understanding Price: how it moves and trends

What do I look for? What am I trying to catch when trading the forex market on the hourly chart?

I know that market remains in a breakout phase, only 10% of the time.

I also know that the D1 chart produces 2-3 consecutive trend candles during that breakout phase.

I want to catch those moves when they happen. Usually, I'll be able to catch the First Trend candle of the D1 when it breaks out on the H1.

An example of this is the EUR/USD trade I took on the 9th of June.

I knew that EUR/USD was consolidating and not moving strong. It was within a TR on the D1. Which meant a wide trading range on the H1 that lasted several days.

I knew it, I was watching it. Now combine that with the fact the MARKETS ARE DRIVEN BY NEWS (especially forex).

The interest rate decisions carry more weight these days since governments are trying to curb inflation and the cost of living. The central banks around the world want to control inflation and for that, they need to adjust bank interest rates.

On the 9th ECB made a decision. (no change). Which created strong 2 trend candles on the hourly chart. It broke the TR levels of H1 as well as the D1.

Now in this case I caught the beginning of the move/wave. If I wanted, and if I could I would have let it run for the next 2 days, allowing me to grab a 20R winner but I got myself a 3R and a 10R winner on two accounts. More than enough for me.

I could see that D1 chart at clear levels to the left. I can remember telling my son, "This can be a 20K trade (10R). Maybe even a 30K (15R) I closed it when it hit the target but my first target was the Daily levels. Hard to let it run but that is what makes you the money.

I can also catch the 2nd-day play, the 2nd day after a clear Trend candle on the D1 chart. I did that on the DAX on the same date 9th of June.

Dax was in a wedge channel losing momentum to the upside on the daily chart. then on the 8th it broke below the channel and created a Trend candle. A bearish one. That translated into a strong bear wave (impulse) on the H1.

You can see in the DAX D1 chart above, that since my trade on H1 was in line with the trend on D1, or the possible new bear trend, I had the option to simply LET IT RUN on the D1 chart. That would have turned this 1K risk trade into $20K winner and some more add-ons.

I want to have my trades in line with the Daily chart information. I am essentially trading the Daily chart with entries on the H1 and exits are based on R multiples not really based on H1 chart. Or you can say that they are based on the h1 chart, but really my exits are simply R multiples.

It is important to understand that the above scenarios, do happen, but not every day. They are HIGHER probability events.

These things happen on the M1 chart as well, but you don't benefit from the overall feel of the market. The trend of the overall market. You just react to volatility breakouts and look for momentum. If you want, you can mark these levels off h1 and pursue them, but the game gets complicated and you will lose the plot.

The CIP or VIP

M1 should be used for CIP only. The chaos of Volatility influx point. VIP... Where is the VIP?

This happens nearly every day at the opening of the indices. It does not work for forex. Forex DOES Not have open time volatility changes. But forex reacts to its relevant news better than indices. So the VIP or CIP for FOREX is the News events. News will provide great opportunities for both swing or day traders. For M1, you will look at the momentum breakout and catch a pullback. For H1, you will see if the news creates a strong enough reaction that the tsunami of orders begins and continues for the next 2-3 days.

The main difference between an intraday scalp of M1 and swing or day trade of H1 is that for the hourly time frame, the Setup pattern is not enough. IT must be in line with the trend. On the m1, in most cases, a strong pattern usually works as long as it is not during the DEAD hours.

Pattern of TTTPP , when it happens at the Sesssion Open on the 5 or 1-minute chart, has a higher, much higher probability than when it happens within dead hours. It is also different for hourly charts. IF the pattern appears straight after the news event and clears levels to the left, it has more power (probability).

MORE SHAKEOUTS on M1 and M5

The lower time frame, especially in forex, will have a lot more FAKE outs and shakeouts (when you are shaken out by a spike that goes against your trade and trade gets kicked out by a pip or two and then price resumes in the direction of the signal).

It TAKES a lot more money to turn an hourly chart around than it does to turn an M1 chart.

What do I look for? What am I trying to catch when trading the forex market on the hourly chart?

I know that market remains in a breakout phase, only 10% of the time.

I also know that the D1 chart produces 2-3 consecutive trend candles during that breakout phase.

I want to catch those moves when they happen. Usually, I'll be able to catch the First Trend candle of the D1 when it breaks out on the H1.

An example of this is the EUR/USD trade I took on the 9th of June.

I knew that EUR/USD was consolidating and not moving strong. It was within a TR on the D1. Which meant a wide trading range on the H1 that lasted several days.

I knew it, I was watching it. Now combine that with the fact the MARKETS ARE DRIVEN BY NEWS (especially forex).

The interest rate decisions carry more weight these days since governments are trying to curb inflation and the cost of living. The central banks around the world want to control inflation and for that, they need to adjust bank interest rates.

On the 9th ECB made a decision. (no change). Which created strong 2 trend candles on the hourly chart. It broke the TR levels of H1 as well as the D1.

Now in this case I caught the beginning of the move/wave. If I wanted, and if I could I would have let it run for the next 2 days, allowing me to grab a 20R winner but I got myself a 3R and a 10R winner on two accounts. More than enough for me.

I could see that D1 chart at clear levels to the left. I can remember telling my son, "This can be a 20K trade (10R). Maybe even a 30K (15R) I closed it when it hit the target but my first target was the Daily levels. Hard to let it run but that is what makes you the money.

I can also catch the 2nd-day play, the 2nd day after a clear Trend candle on the D1 chart. I did that on the DAX on the same date 9th of June.

Dax was in a wedge channel losing momentum to the upside on the daily chart. then on the 8th it broke below the channel and created a Trend candle. A bearish one. That translated into a strong bear wave (impulse) on the H1.

You can see in the DAX D1 chart above, that since my trade on H1 was in line with the trend on D1, or the possible new bear trend, I had the option to simply LET IT RUN on the D1 chart. That would have turned this 1K risk trade into $20K winner and some more add-ons.

I want to have my trades in line with the Daily chart information. I am essentially trading the Daily chart with entries on the H1 and exits are based on R multiples not really based on H1 chart. Or you can say that they are based on the h1 chart, but really my exits are simply R multiples.

It is important to understand that the above scenarios, do happen, but not every day. They are HIGHER probability events.

These things happen on the M1 chart as well, but you don't benefit from the overall feel of the market. The trend of the overall market. You just react to volatility breakouts and look for momentum. If you want, you can mark these levels off h1 and pursue them, but the game gets complicated and you will lose the plot.

The CIP or VIP

M1 should be used for CIP only. The chaos of Volatility influx point. VIP... Where is the VIP?

This happens nearly every day at the opening of the indices. It does not work for forex. Forex DOES Not have open time volatility changes. But forex reacts to its relevant news better than indices. So the VIP or CIP for FOREX is the News events. News will provide great opportunities for both swing or day traders. For M1, you will look at the momentum breakout and catch a pullback. For H1, you will see if the news creates a strong enough reaction that the tsunami of orders begins and continues for the next 2-3 days.

The main difference between an intraday scalp of M1 and swing or day trade of H1 is that for the hourly time frame, the Setup pattern is not enough. IT must be in line with the trend. On the m1, in most cases, a strong pattern usually works as long as it is not during the DEAD hours.

Pattern of TTTPP , when it happens at the Sesssion Open on the 5 or 1-minute chart, has a higher, much higher probability than when it happens within dead hours. It is also different for hourly charts. IF the pattern appears straight after the news event and clears levels to the left, it has more power (probability).

MORE SHAKEOUTS on M1 and M5

The lower time frame, especially in forex, will have a lot more FAKE outs and shakeouts (when you are shaken out by a spike that goes against your trade and trade gets kicked out by a pip or two and then price resumes in the direction of the signal).

It TAKES a lot more money to turn an hourly chart around than it does to turn an M1 chart.