I have read through the materials and am now making my way through The Seed thread. I also plan to join the Skype group soon but my day job is kinda crazy at the moment and I can't commit to London and NY open most days..

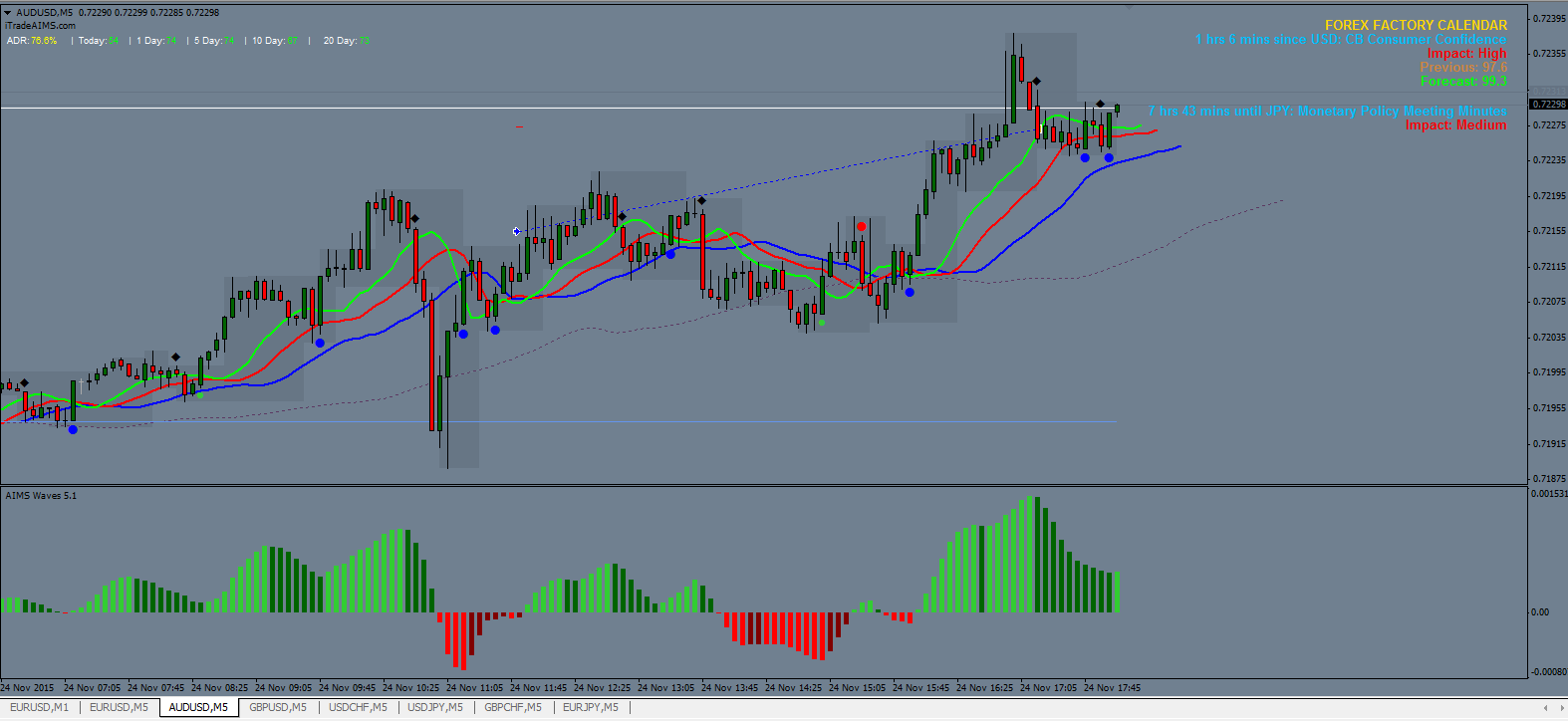

In the meantime I am learning on M5 and H1 using S1 and S2. I work through the day and have times when trading is not possible so my posts might be sporadic, but I shall be applying the T20 principals.

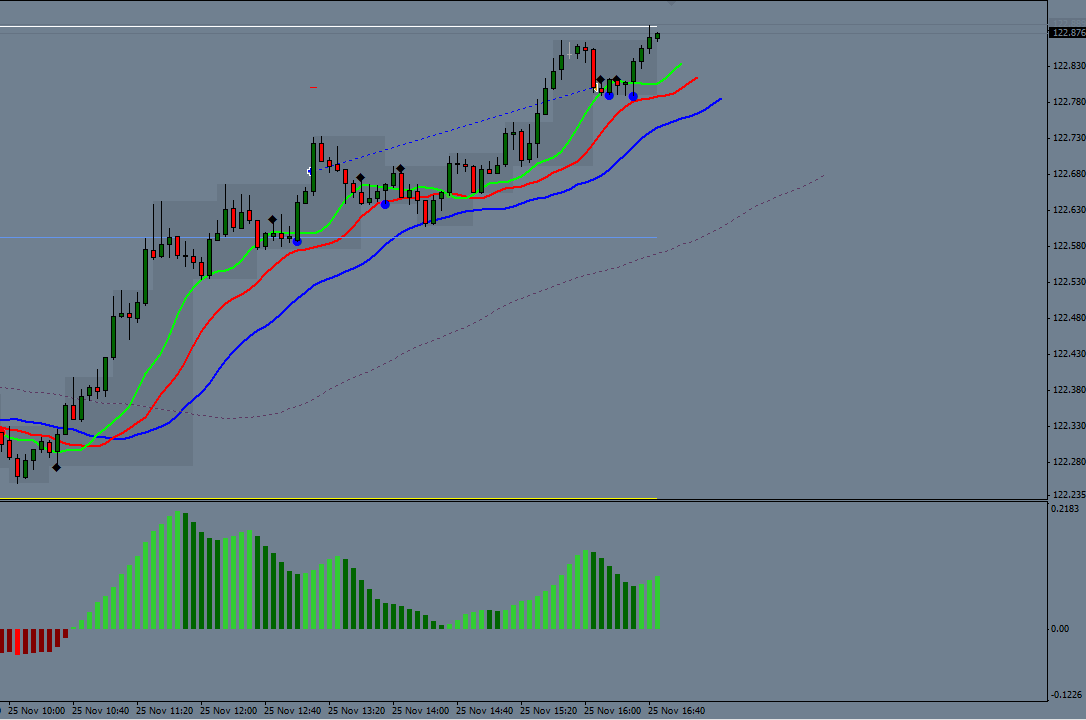

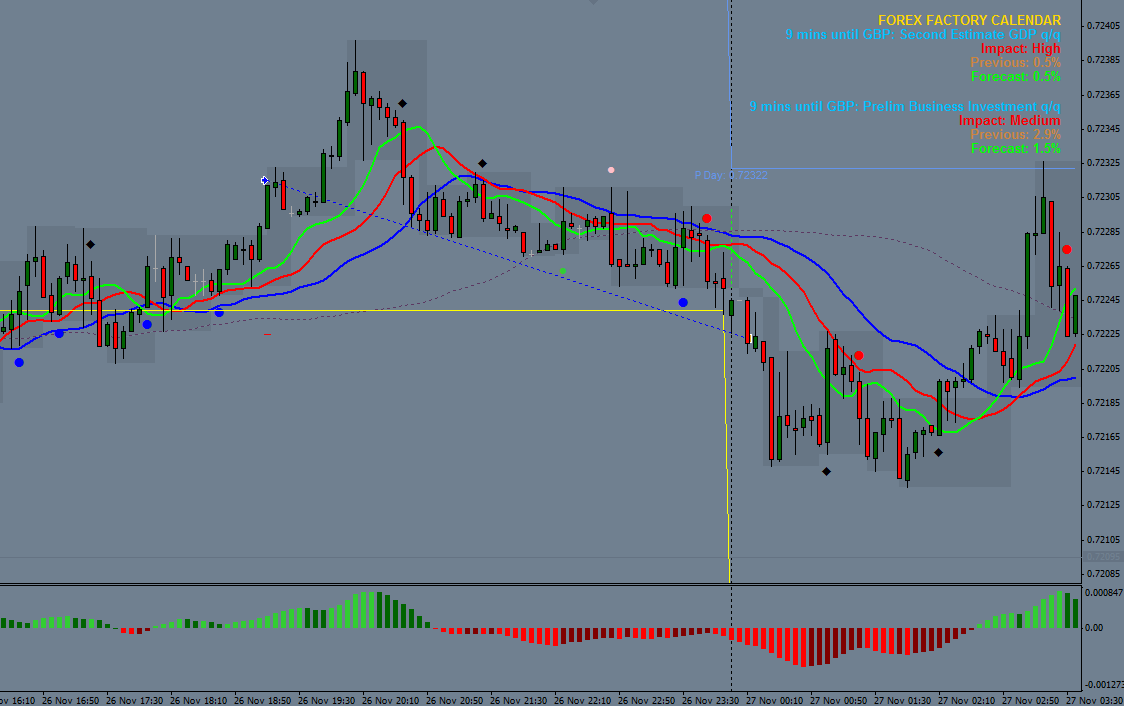

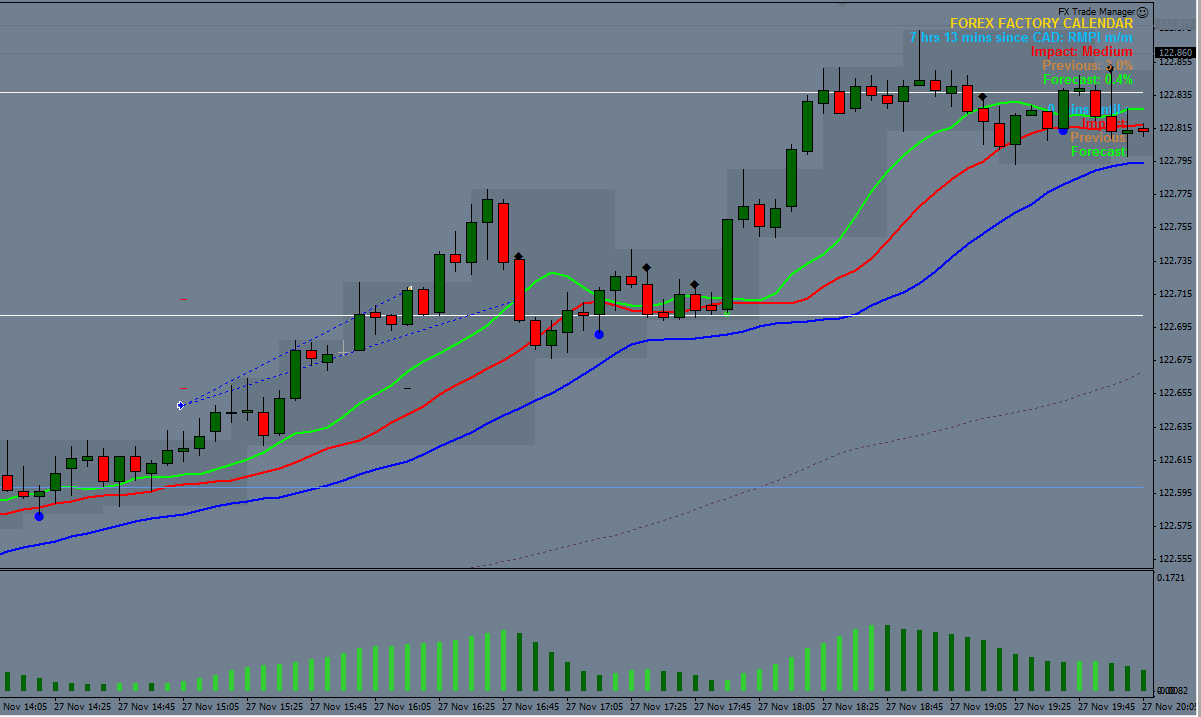

My first trade

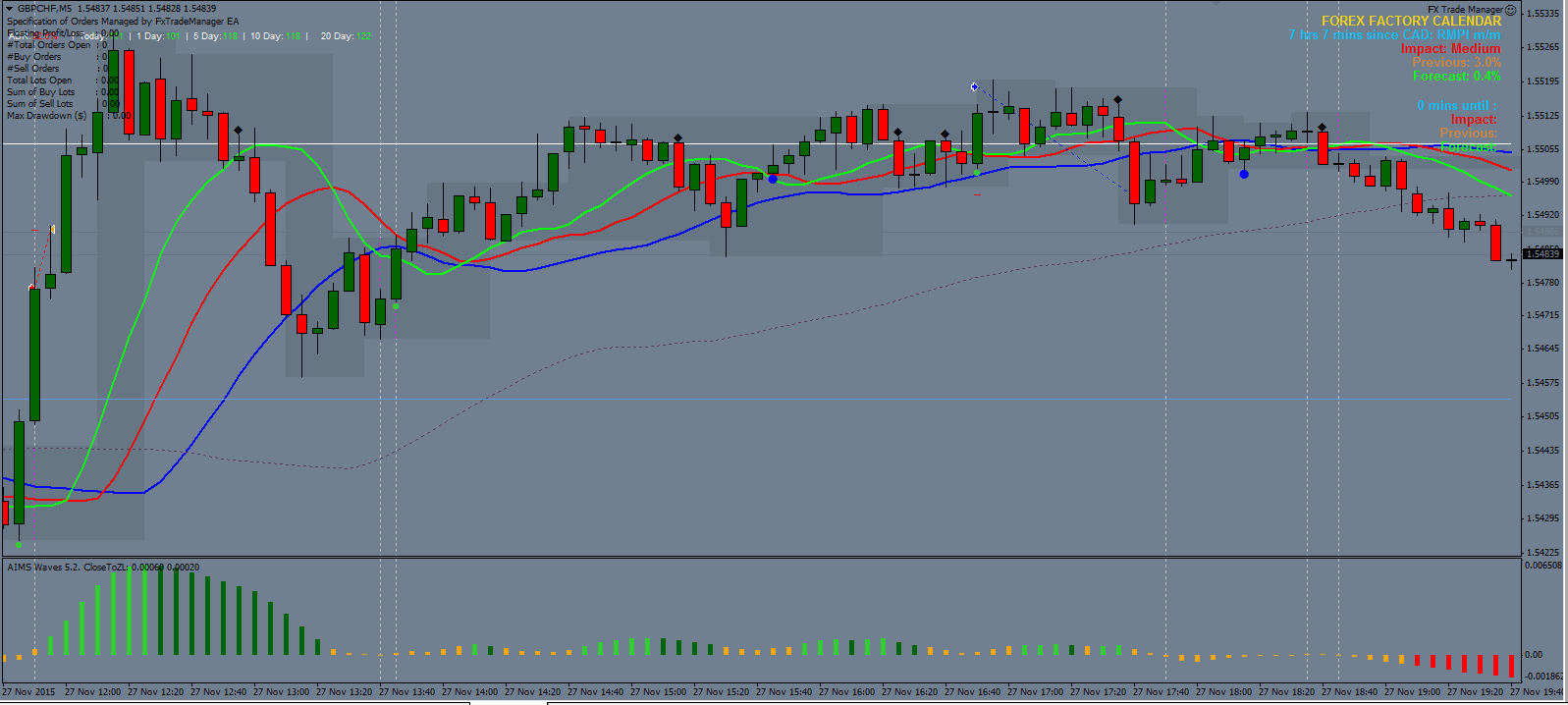

The pip distance on M1 AIMs level box was 6 pips and the entry on M5 was an S2 (right?..). The trade went against me for a while and nearly stopped out at 14:50 but my SL being 1pip below AIMS level low kept me in the trade by just 0.8pip. I like to use pivot points and watched PA push through but then retrace back. I had set SL at green MA and was stopped out with 11.8 pips

1: +11.8 1R:1R